Announcement,Partnership

dtcpay Collaborates with iStudio to Enable Web3 Payments

Bringing retailers to the forefront of digital payments, dtcpay’s partnership with iStudio is set to provide better payment flexibility and reliability than ever before.

31 Jul 2025 • 4 mins Read

Table of Contents

- Press Release

- iStudio Brings Stablecoin Payment to Enhance Shopping Experience

- Stablecoin Payment Benefits Through Seamless Integration of dtcpay’s POS Solution

- Pushing the Adoption of Digital Assets in the Real World

- Bridging the Gap Between Traditional and Future Retail Payments

- About dtcpay

- About iStudio Singapore

dtcpay’s stablecoin acceptance service has garnered the trust of iStudio, further highlighting its reliability and efficiency.

Press Release

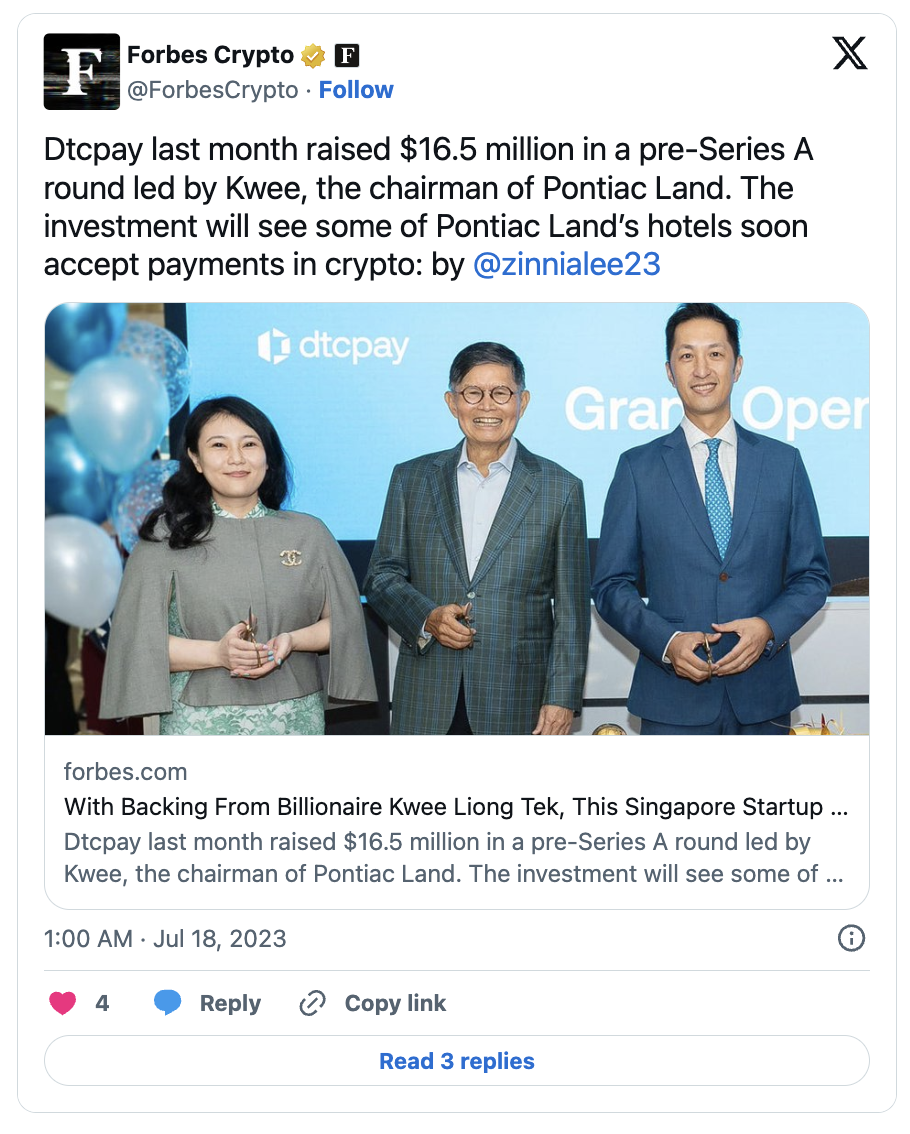

Singapore, [31 July 2025] — dtcpay a regulated digital payment solutions provider licensed by the Monetary Authority of Singapore (MAS), is excited to announce a partnership with iStudio, Singapore’s largest Apple Premium Partner.

Through this collaboration, dtcpay’s stablecoin and fiat-ready Point-of-Sale (POS) systems, along with WeChat Pay, have now been deployed across all 22 iStudio retail outlets island-wide, enabling customers to make seamless purchases using both fiat currencies and stablecoins such as USDT and USDC, further enhancing the shopping experience of its customers.

iStudio Brings Stablecoin Payment to Enhance Shopping Experience

iStudio’s decision to partner with dtcpay marks a strategic milestone in Singapore’s retail and Web3 ecosystems. A household brand known for its premium Apple lifestyle offerings, iStudio is now embracing cutting-edge Web3 technology by integrating blockchain-enabled payment options at the point of sale.

This move signals a clear step forward in the evolution of consumer payment preferences, especially among digitally savvy customers who wish to use stablecoins in their daily purchases. This further positions iStudio as a forward-thinking brand that understands the growing demand for payment flexibility, stablecoin usability, and seamless customer experience.

We’re thrilled to partner with dtcpay to bring stablecoin and fiat payment solutions to all 22 iStudio outlets across Singapore. This marks an exciting step forward as we embrace innovation to enhance our customers’ retail experience. We look forward to offering even more flexible, secure, and seamless payment options that align with the evolving needs of today’s digitally savvy shoppers.

Jeremy Lin

Head of Marketing of iStudio

Stablecoin Payment Benefits Through Seamless Integration of dtcpay’s POS Solution

The implementation of dtcpay’s POS system, along with the ability to pay through WeChat Pay, across all 22 iStudio outlets reflects not just a technology adoption but a shift in retail experience and operational efficiency.

Here’s how the dtcpay POS system empowers and enhances the iStudio retail experience to further provide a seamless customer experience:

- Instant acceptance of multiple stablecoins and fiat currencies:

dtcpay’s secure and reliable POS solution empowers iStudio to seamlessly accept both traditional fiat and stablecoins payment—enhancing customer flexibility at checkout.

- Real-time conversion and settlement:

Ensure that transactions are smooth and compliant for more secure transactions.

- Payment through WeChat Pay: dtcpay allows WeChat Pay on the dtcpay POS device as an alternative payment option, empowering merchants and customers with more payment flexibility.

This marks another step toward bridging digital assets with everyday retail. With stablecoin payments now available at iStudio, shoppers can enjoy the convenience of using USDT or USDC—without worrying about volatility—right at checkout.

Andy Sze Toh

Commercial Director, dtcpay

Pushing the Adoption of Digital Assets in the Real World

Bridging the Gap Between Traditional and Future Retail Payments

***

Media Contacts

marketing@dtcpay.com

dtcpay

About dtcpay

Learn more at dtcpay.com.

About iStudio Singapore

iStudio is Singapore’s biggest Apple Premium Partner (22 stores islandwide), bringing a boutique Apple Experience closer to you. iStudio opened its inaugural boutique at Terminal 3 of Singapore Changi Airport in 2007; being one of the first Apple Premium Resellers located in a Duty Free Departure/Transit Hall. iStudio is proudly Singapore’s first and only Apple Premium Reseller to offer tax-free purchases for patrons departing from the Singapore Changi Airport, also available on iShopChangi. n 2016, they launched their eCommerce, istudiosg.com, reaching out to larger audiences in Singapore and beyond, offering a wide variety of exclusive online promotions only at iStudio.

Learn more at istudiosg.com.

Band Zhao, Group Chairman of dtcpay and CEO of dtcpay Luxembourg, with Gilles Roth, Minister of Finance of Luxembourg

Band Zhao, Group Chairman of dtcpay and CEO of dtcpay Luxembourg, with Gilles Roth, Minister of Finance of Luxembourg

dtcpay’s Co-Founders, Alice Liu and Band Zhao, with Dean of the NUS Business School, Prof Andrew K Rose

dtcpay’s Co-Founders, Alice Liu and Band Zhao, with Dean of the NUS Business School, Prof Andrew K Rose

Alice Liu, CEO of dtcpay

Alice Liu, CEO of dtcpay

Prof Andrew K Rose, Dean of NUS Business School

Prof Andrew K Rose, Dean of NUS Business School

‘The Intersection of Web2 and Web3′ bar

‘The Intersection of Web2 and Web3′ bar

Specially concocted cocktails named after Visa and dtcpay’s innovative products

Specially concocted cocktails named after Visa and dtcpay’s innovative products

An interactive journey through time, as we step into a new era of payments

An interactive journey through time, as we step into a new era of payments

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

MBTI-based game for guests to discover their Blockchain Scent

MBTI-based game for guests to discover their Blockchain Scent

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay

Sam Lin, dtcpay’s Chief Technology Officer, receiving the award.

Sam Lin, dtcpay’s Chief Technology Officer, receiving the award.

Keian Wong

Keian Wong

Penny Chai

Penny Chai

Anson Zeall

Anson Zeall

Digital payment providers say more businesses are taking up cryptocurrency payments. One company has seen transactions jump over 300 per cent. CNA finds out that the boost is driven by stablecoins.

Digital payment providers say more businesses are taking up cryptocurrency payments. One company has seen transactions jump over 300 per cent. CNA finds out that the boost is driven by stablecoins.

From left to right: Richmond Teo from Paxos presenting El Lee, Chief Operating Officer of Digital Treasures Center, the Top 10 Fintech Leaders award during Singapore Fintech Festival.

From left to right: Richmond Teo from Paxos presenting El Lee, Chief Operating Officer of Digital Treasures Center, the Top 10 Fintech Leaders award during Singapore Fintech Festival.

Photo credit: Håkan Dahlström Photography

Photo credit: Håkan Dahlström Photography