Media Feature

dtcpay Award Launched at NUS to Empower Future Fintech Leaders

dtcpay has introduced the dtcpay Award at NUS to recognise outstanding students in fintech-focused courses. Presented annually across undergraduate, MBA, and Master of Finance programmes at NUS Business School, the award includes a cash prize and exclusive internship opportunities at dtcpay.

2 Apr 2025 • 2 mins Read

As featured on Fintech News Singapore, 01 April 2025

Award recipients will be offered internship opportunities at dtcpay in addition to cash prize.

Digital payments provider dtcpay has introduced the dtcpay Award at the National University of Singapore (NUS) to recognise top-performing students in fintech-focused courses and strengthen collaboration between academia and industry.

The award will be presented annually to students who excel in three fintech-related courses across the undergraduate, MBA, and Master of Finance programmes at NUS Business School.

In addition to a cash prize, recipients will be offered internship opportunities at dtcpay, where they will gain hands-on experience, work with the company’s leadership team, and access resources to support their professional development.

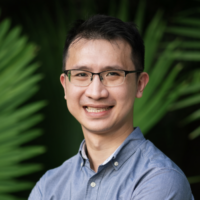

dtcpay’s Co-Founders, Alice Liu and Band Zhao, with Dean of the NUS Business School, Prof Andrew K Rose

dtcpay’s Co-Founders, Alice Liu and Band Zhao, with Dean of the NUS Business School, Prof Andrew K Rose

The initiative is part of dtcpay’s broader effort to encourage interest in emerging areas such as blockchain, stablecoins, and artificial intelligence—technologies that are playing an increasingly important role in the financial sector.

said Alice Liu, CEO, dtcpay.

Alice Liu, CEO of dtcpay

Alice Liu, CEO of dtcpay

“With the dtcpay Award, we aim to empower students who have demonstrated exceptional potential in fintech, helping them take their talents to the next level. This sponsorship aligns with our company’s core values of fostering innovation and encouraging future leaders to challenge the status quo. We would like to take this opportunity to express our gratitude to the National University of Singapore for the chance to contribute to the development of its students. We wish all future recipients of the dtcpay Award the very best in their academic and professional pursuits.”

Alice Liu

CEO, dtcpay

The award was established through a donation by dtcpay and its co-founders, Alice Liu and Band Zhao, both Executive MBA alumni of NUS Business School.

said Prof Andrew K Rose, Dean of NUS Business School.

“As we celebrate the 60th anniversary of NUS Business School, we are deeply grateful for the visionary leadership of Ms Alice Liu and Mr Band Zhao. Established with the generous donation of dtcpay, this award empowers our students to excel in the dynamic fields of blockchain and fintech, driving the future of finance. Through their commitment, dtcpay not only supports academic excellence but also strengthens the vital link between education and industry. We look forward to deepening this impactful partnership and shaping the next generation of global financial leaders together,”

Prof Andrew K Rose

Dean of NUS Business School

Prof Andrew K Rose, Dean of NUS Business School

Prof Andrew K Rose, Dean of NUS Business School

The partnership reflects a shared goal of equipping students with the skills and exposure needed to navigate a rapidly evolving financial landscape.

Keian Wong

Keian Wong

Penny Chai

Penny Chai

Anson Zeall

Anson Zeall

Digital payment providers say more businesses are taking up cryptocurrency payments. One company has seen transactions jump over 300 per cent. CNA finds out that the boost is driven by stablecoins.

Digital payment providers say more businesses are taking up cryptocurrency payments. One company has seen transactions jump over 300 per cent. CNA finds out that the boost is driven by stablecoins.