Industry Insights

How dtcpay Enables Merchants to Accept Cryptocurrencies

In an era marked by rapid technological advancements, the adoption of cryptocurrencies as a legitimate form of payment is gaining momentum. Merchants are increasingly recognizing the need to integrate cryptocurrency payments into their business models, opening up new opportunities for growth and customer engagement.

6 Dec 2023 • 4 mins Read

Table of Contents

- Understanding the Cryptocurrency Landscape

- Multi-Currency Swaps: Your Gateway to Global Transactions

- In-Store POS Solution: Now with a Mobile POS (mPOS+) Functionality!

- Online Checkouts: Made Effortless for Optimal Conversions

- dtcpay Card: Seamless Fiat to Crypto Payments

- The dtcpay Advantage

- Conclusion

- About dtcpay

In this article, we will explore the key aspects of collecting cryptocurrency payments, leveraging our company’s unique offerings, including multi-currency swaps, in-store & mobile POS solutions, online checkouts, as well as a newly launched dtcpay card.

In an era marked by rapid technological advancements, the adoption of cryptocurrencies as a legitimate form of payment is gaining momentum. Merchants are increasingly recognizing the need to integrate cryptocurrency payments into their business models, opening up new opportunities for growth and customer engagement.

As a leading payment solution company regulated and licensed by the Monetary Authority of Singapore (MAS), dtcpay’s mission is to facilitate the transition into the era of digital payments by offering innovative products and services that cater to the evolving needs of businesses in the global marketplace.

How dtcpay Enables Merchants to Accept Cryptocurrencies

How dtcpay Enables Merchants to Accept Cryptocurrencies

Understanding the Cryptocurrency Landscape

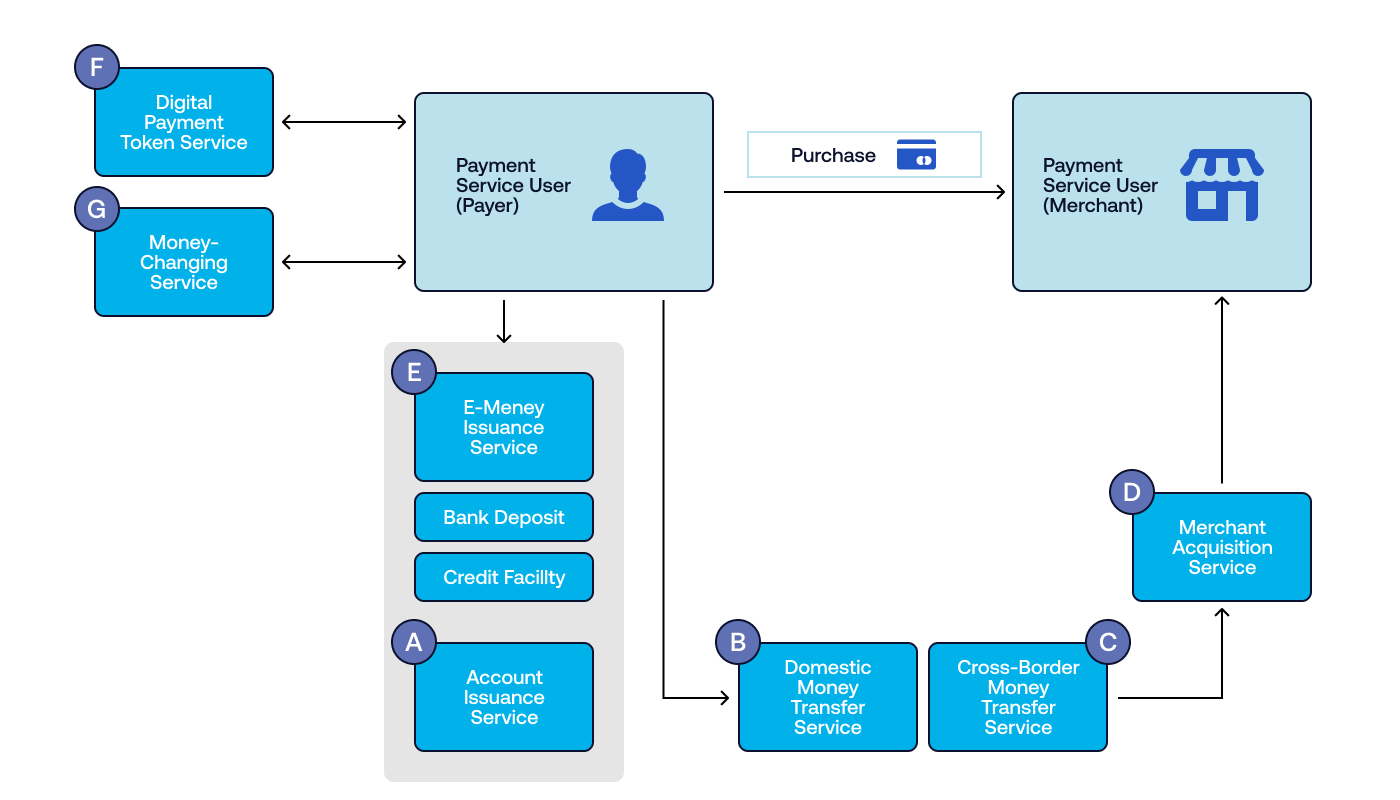

To embark on the journey of accepting cryptocurrency payments, it is essential for merchants to have a solid understanding of the cryptocurrency landscape. As a licensed Major Payment Institution (MPI), dtcpay operates under the regulation and oversight of the Monetary Authority of Singapore, ensuring compliance with industry standards and providing merchants with a trustworthy partner for their payment needs.

Multi-Currency Swaps: Your Gateway to Global Transactions

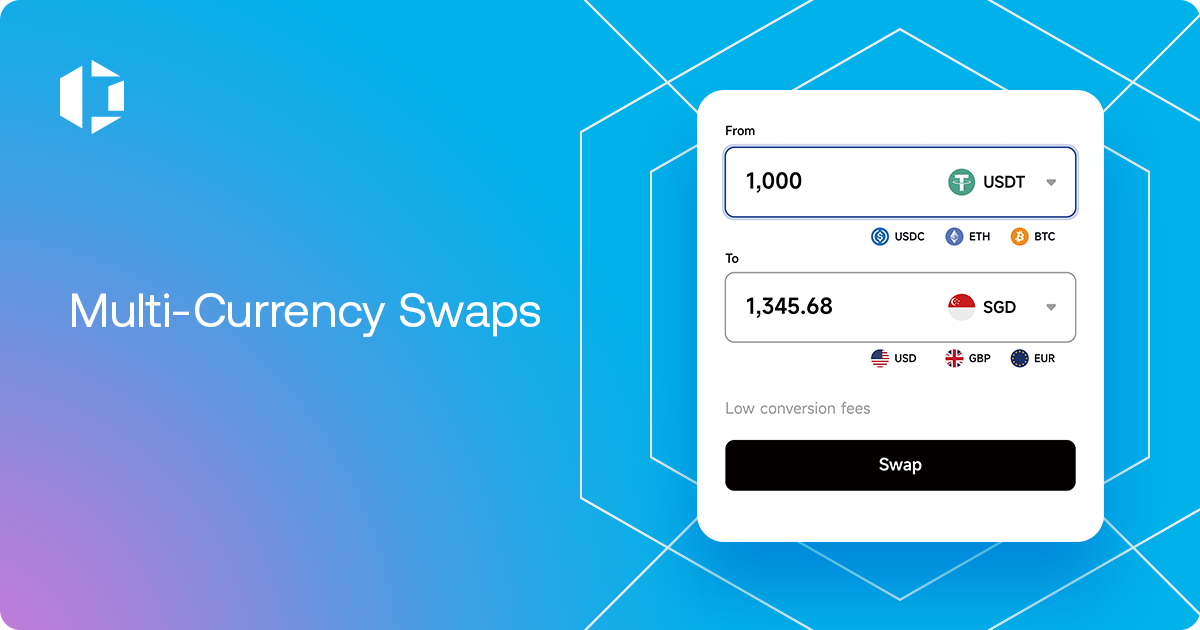

One of the standout features of our payment solution is the ability to facilitate multi-currency swaps.

This empowers merchants to conduct transactions seamlessly across borders, mitigating the impact of currency fluctuations.

We understand that in the global marketplace, businesses need flexibility, and our multi-currency swap feature addresses this need, allowing merchants to transact in the currency of their choice.

Learn more about our multi-currency swaps here.

Create a free account here and start swapping instantly.

Sign up for a free business account here.

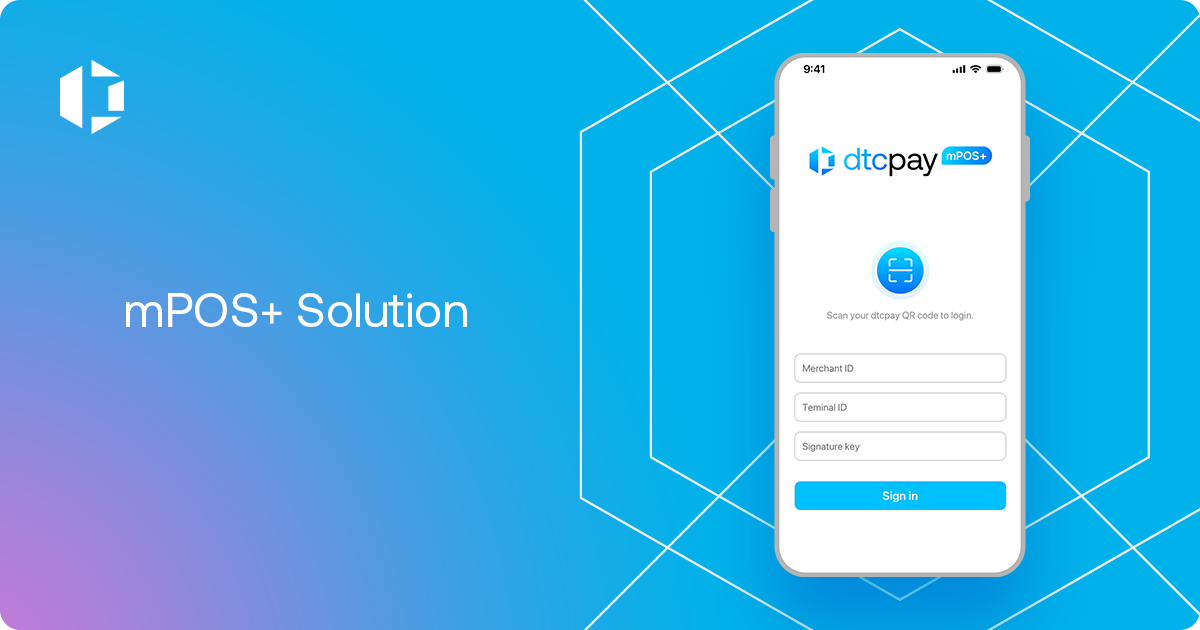

In-Store POS Solution: Now with a Mobile POS (mPOS+) Functionality!

For brick-and-mortar businesses, having reliable in-store Point-of-Sale (POS) terminals is crucial.

Our solution goes beyond traditional POS systems by integrating blockchain technology and enabling mobile POS functionality.

Merchants can now effortlessly accept payments in USDT, USDC, BTC, and ETH anytime, anywhere, offering unparalleled flexibility for businesses engaged in events, pop-up shops, or on-the-go transactions.

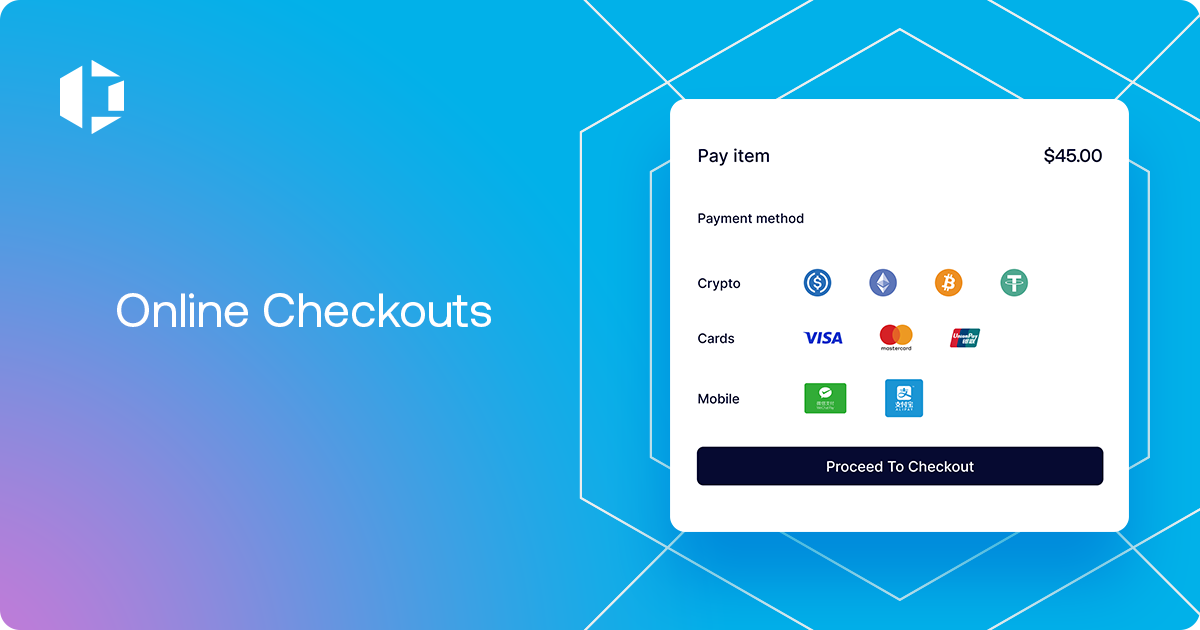

Online Checkouts: Made Effortless for Optimal Conversions

In the dynamic world of e-commerce, providing a seamless online checkout experience is paramount.

Through straightforward API integration, we empower your business to accept a diverse range of secure online payment methods, including popular providers like WeChat Pay, Alipay (coming soon), and UnionPay (coming soon), along with cryptocurrencies.

This variety simplifies the checkout process and boosts conversion rates, tapping into the vast potential of hundreds of millions of crypto owners in Asia seeking to pay with cryptocurrencies.

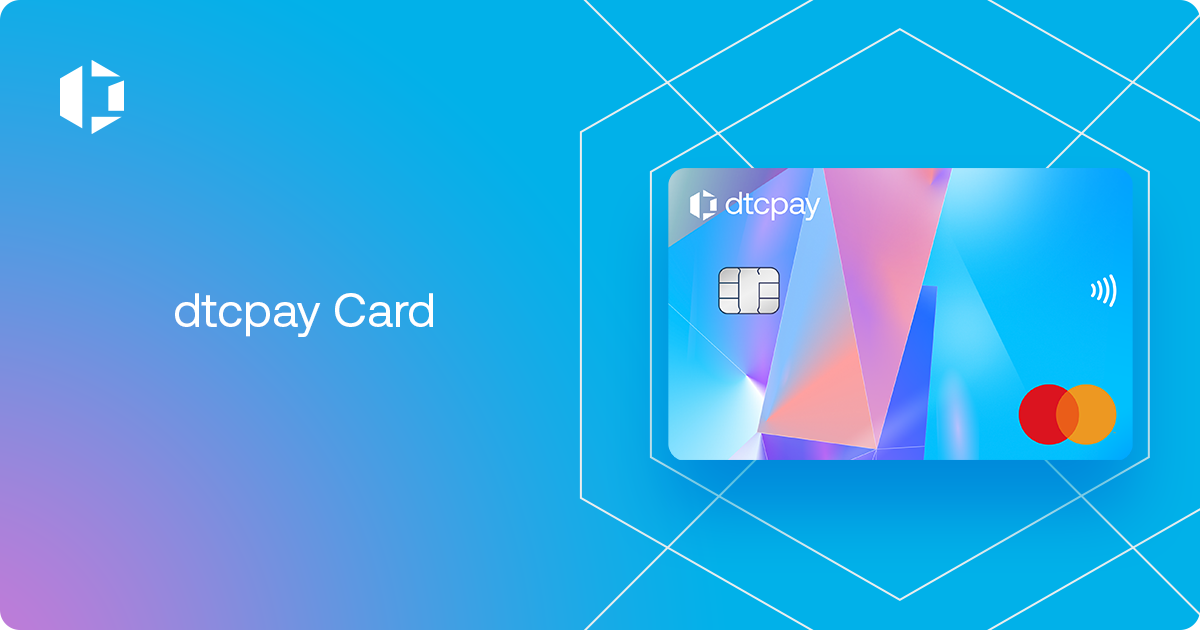

dtcpay Card: Seamless Fiat to Crypto Payments

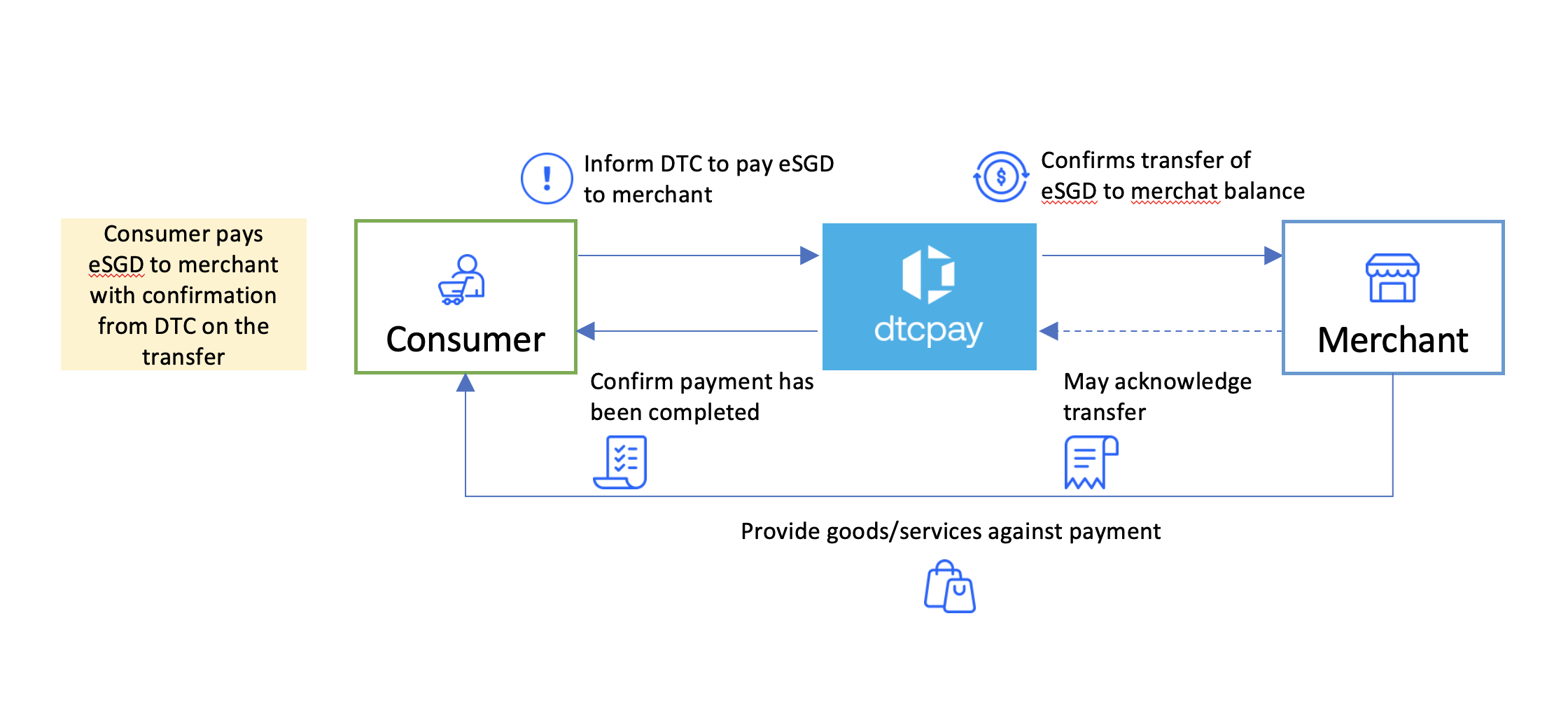

The dtcpay card is a revolutionary solution that bridges the gap between the cryptocurrency and traditional payment worlds.

Businesses and individuals can use this card to make purchases at over 90 million Mastercard acceptance locations worldwide.

What sets our dtcpay card apart is the ability for users to pay in cryptocurrency while receiving invoices in their local currency, streamlining the reconciliation process for both merchants and consumers.

The dtcpay Advantage

In the competitive landscape of payment solutions, dtcpay distinguishes itself having acquired the highly-coveted Digital Payment Token (DPT) license from the Monetary Authority of Singapore (MAS).

Granted to just 15 companies from a pool of hundreds of applicants, this accreditation underscores our commitment to regulatory compliance, positioning us as a trusted partner for merchants entering the world of cryptocurrency payments.

By empowering merchants to accept cryptocurrencies with the same security and peace of mind they would have with any other payment method, we’re enabling an increased uptake of crypto payments, building real-world use cases for web3, one merchant at a time.

Conclusion

As the global economy continues to evolve, embracing innovative payment solutions becomes a strategic imperative for merchants and businesses alike.

Our payment solution gateway, with its unique combination of regulatory compliance, multi-currency swaps, in-store POS terminals, online checkouts, and the new dtcpay card, is poised to revolutionize the way businesses approach cryptocurrency payments.

By staying ahead of the curve and leveraging our cutting-edge offerings, merchants can unlock new avenues for growth and seamlessly transition into the era of digital payments.

Learn how merchants are growing their businesses with dtcpay.

About dtcpay

dtcpay is a regulated payment service provider that offers reliable solutions for merchants to grow their revenues with higher acceptance rates for Fiat and cryptocurrency transactions. Our client’s customers benefit from frictionless payment experiences whether they are using our award-winning POS+ terminal in-store or using our online checkout.

Founded in 2019 in Singapore, dtcpay is a licensed Major Payment Institution (MPI) under the Monetary Authority of Singapore (MAS) and offers Digital Payment Token (DPT) services.

Website | Blog | LinkedIn | X | Instagram | Facebook | YouTube